Business Liability Insurance: Shield Your Venture!

Business liability insurance protects businesses from financial loss due to legal claims. It covers costs associated with lawsuits and damages incurred.

Businesses face various risks daily, such as accidents, injuries, or property damage. In the event of a lawsuit, having liability insurance can provide crucial financial protection. This type of insurance is essential for businesses of all sizes and industries to safeguard their assets and reputation.

By understanding the importance of business liability insurance, companies can mitigate potential risks and ensure their long-term success. Investing in this coverage can offer peace of mind and financial security in an unpredictable business environment.

The Basics Of Business Liability Insurance

Business liability insurance is a crucial protection for any business, regardless of its size or industry. Understanding the basics of business liability insurance is essential for every business owner to safeguard their company from potential financial risks and legal liabilities.

What Is Business Liability Insurance?

Business liability insurance, also known as commercial general liability insurance, is a type of insurance that provides coverage for a business in the event of third-party claims of bodily injury, property damage, or advertising injury. This insurance protects the business from financial losses due to legal actions brought against the company.

Importance Of Business Liability Insurance

The importance of business liability insurance cannot be overstated. It shields a business from the financial burden of legal claims, medical expenses, and property damage costs. Additionally, it instills confidence in customers, suppliers, and partners, demonstrating the company’s commitment to mitigating risks and ensuring financial stability.

Types Of Business Liability Insurance

Business liability insurance is essential for protecting your company from potential financial losses due to legal claims. There are different types of business liability insurance that cater to various aspects of a business’s operations.

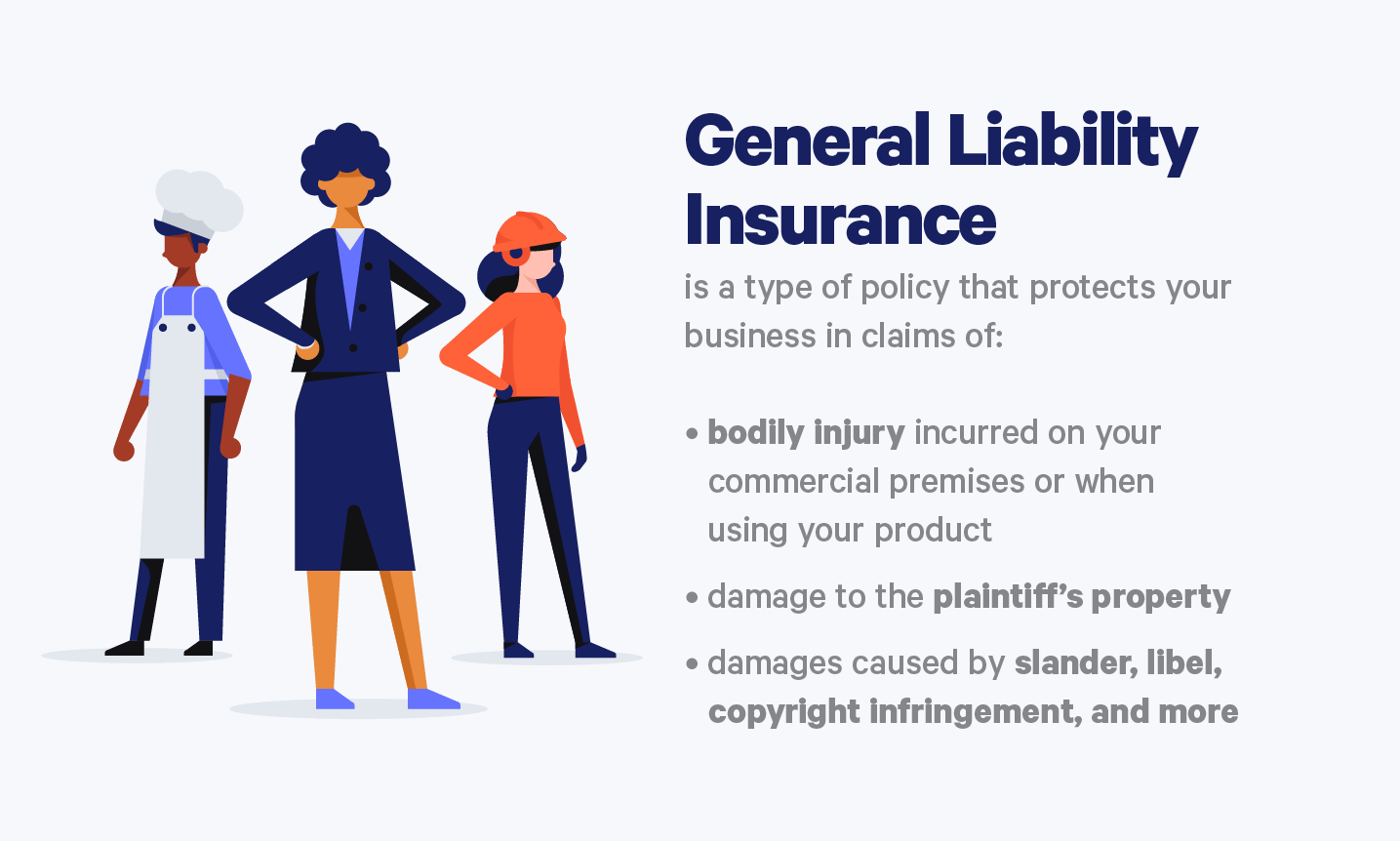

General Liability Insurance

General liability insurance provides coverage for common risks faced by businesses, including bodily injury, property damage, and advertising injury. It safeguards your company against lawsuits related to third-party injuries or property damage that occur on your business premises.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, is crucial for businesses offering professional services. It offers protection against claims of negligence, errors, or omissions in the services provided by the business. This type of insurance is particularly important for professions such as lawyers, doctors, and consultants.

Product Liability Insurance

Product liability insurance is essential for businesses that manufacture, distribute, or sell products. It provides coverage for claims related to bodily injury or property damage caused by the products your business produces or sells. This type of insurance is vital in today’s litigious environment where product-related lawsuits are common.

Factors To Consider When Choosing Business Liability Insurance

When it comes to safeguarding your business, choosing the right liability insurance is crucial. Understanding the factors to consider when selecting business liability insurance can help you make an informed decision that aligns with your specific needs and risk exposure. Here are the key aspects to keep in mind when evaluating business liability insurance options:

Nature Of Business Operations

The nature of your business operations plays a significant role in determining the most suitable liability insurance coverage. Whether you operate a retail establishment, professional service, or manufacturing facility, it’s essential to assess the unique risks associated with your industry. For instance, a construction company may require coverage for bodily injury or property damage resulting from construction activities, while a technology firm might prioritize protection against data breaches or intellectual property infringement.

Level Of Risk Exposure

Assessing the level of risk exposure is imperative when choosing business liability insurance. Factors such as the frequency of customer interactions, the complexity of services offered, and the potential for third-party claims should be carefully evaluated. High-risk industries or businesses with extensive customer interactions may necessitate higher coverage limits to mitigate potential liabilities effectively.

Legal Requirements

Understanding the legal requirements pertaining to liability insurance in your jurisdiction is essential. Compliance with state or industry-specific regulations is paramount to avoid legal repercussions and financial penalties. Additionally, certain contracts or partnerships may mandate specific liability coverage, making it imperative to align your insurance choices with these legal obligations.

Credit: www.mutualbenefitgroup.com

Key Differences Between Business Liability Insurance And Other Types Of Insurance

Business liability insurance differs from other types by covering legal costs and damages resulting from third-party claims against a business. It protects against financial losses due to lawsuits, property damage, or bodily injuries caused by the business operations. This insurance is crucial for safeguarding businesses from potential liabilities.

Business liability insurance is crucial for any business to protect against unforeseen circumstances. However, there are other types of insurance that businesses may require, including property insurance and workers’ compensation. It is essential to understand the key differences between these types of insurance to ensure that your business is adequately protected.

Property Insurance Vs. Business Liability Insurance

Property insurance protects your business against damage to your property, including buildings, equipment, and inventory. On the other hand, business liability insurance protects your business from legal claims made against it, including injury claims or property damage claims caused by your business operations. While property insurance protects your assets, business liability insurance protects your business from financial ruin due to legal claims.

Workers’ Compensation Vs. Business Liability Insurance

Workers’ compensation insurance is designed to provide wage replacement and medical benefits to employees who are injured on the job. Business liability insurance, on the other hand, protects your business against legal claims made by employees or third parties. Workers’ compensation insurance is mandatory in most states, while business liability insurance is not. It is important to note that business liability insurance does not cover employee injuries or illnesses. For this, you will need workers’ compensation insurance. Additionally, business liability insurance does not cover intentional acts or criminal activity, which are typically excluded from coverage. In conclusion, while property insurance and workers’ compensation insurance are important for protecting your business, they do not provide the same coverage as business liability insurance. Business liability insurance is crucial for protecting your business from legal claims and potential financial ruin. By understanding the key differences between these types of insurance, you can ensure that your business is adequately protected.

Costs Associated With Business Liability Insurance

Business liability insurance covers costs related to legal claims from third parties for property damage or bodily injury. It safeguards businesses against financial losses resulting from lawsuits and settlements. This insurance is essential for protecting businesses from potential lawsuits that could impact their financial stability.

As a business owner, it’s crucial to protect your company from legal and financial risks. That’s where business liability insurance comes in. While it may seem like an unnecessary expense, the costs associated with not having liability insurance can be far greater. In this article, we’ll discuss the different costs associated with business liability insurance, including premiums, deductibles, and coverage limits.

Premiums

Premiums are the amount of money you pay to the insurance company for coverage. They can vary depending on the type of business you have, the level of risk associated with your industry, and the amount of coverage you need. Generally, the higher the risk associated with your business, the higher your premiums will be. Factors that can affect your premiums include the size of your business, the number of employees you have, your revenue, and your claims history.

Deductibles

A deductible is the amount of money you agree to pay out of pocket before your insurance coverage kicks in. For example, if you have a $1,000 deductible and a claim for $5,000, you’ll be responsible for paying the first $1,000, and your insurance company will cover the remaining $4,000. Generally, the higher your deductible, the lower your premiums will be.

Coverage Limits

Coverage limits refer to the maximum amount of money your insurance company will pay out for a claim. For example, if you have a $1 million coverage limit and a claim for $1.5 million, you’ll be responsible for paying the remaining $500,000. It’s important to choose a coverage limit that is appropriate for your business. If you have a high-risk business, you may need a higher coverage limit to protect your assets. In conclusion, the costs associated with business liability insurance can vary depending on a variety of factors, including premiums, deductibles, and coverage limits. While it may seem like an unnecessary expense, having liability insurance can protect your business from costly legal and financial risks. It’s important to choose an insurance policy that meets the unique needs of your business and provides adequate coverage.

Credit: www.embroker.com

Steps To Take In The Event Of A Liability Claim

When faced with a liability claim, it’s crucial for businesses to take immediate and strategic action to mitigate the impact. By following the necessary steps, you can effectively navigate through the process and minimize potential damages. Here are the essential steps to take in the event of a liability claim:

Notifying The Insurance Company

Upon receiving notice of a potential liability claim, the first step is to notify your business liability insurance company without delay. This is a critical step to ensure that your policy remains in effect and that the insurance company can initiate the claims process promptly. Failure to notify the insurance company in a timely manner may result in potential coverage issues.

Cooperating With Investigations

Upon receiving notice of a potential liability claim, the first step is to notify your business liability insurance company without delay. This is a critical step to ensure that your policy remains in effect and that the insurance company can initiate the claims process promptly. Failure to notify the insurance company in a timely manner may result in potential coverage issues.

Common Mistakes To Avoid With Business Liability Insurance

When it comes to protecting your business, having the right liability insurance is crucial. However, there are common mistakes that many business owners make when it comes to business liability insurance. By being aware of these mistakes, you can ensure that your business is adequately protected.

Underestimating Coverage Needs

One common mistake that business owners make is underestimating their coverage needs. It’s essential to carefully assess the potential risks and liabilities specific to your business to ensure that you have adequate coverage. Failure to do so can leave your business vulnerable to financial losses in the event of a claim or lawsuit.

Neglecting To Review And Update Policies

Neglecting to review and update your liability insurance policies is another critical mistake. As your business grows and evolves, so do its risks. Failing to regularly review and update your policies can result in gaps in coverage or inadequate protection. It’s important to periodically reassess your insurance needs and make any necessary adjustments to your policies.

The Future Of Business Liability Insurance

The Future of Business Liability Insurance is rapidly evolving as the business landscape continues to change. With emerging risks and technological advancements, it’s crucial for businesses to stay informed about the latest trends and developments in liability insurance coverage. In this article, we’ll delve into the evolving landscape of business liability insurance and explore the key trends and technological advancements impacting this essential form of protection.

Trends In Liability Insurance Coverage

Business liability insurance is witnessing a shift in coverage trends, reflecting the evolving nature of risks businesses face. Increased focus on cyber liability is becoming prominent as businesses grapple with the growing threat of cyber-attacks and data breaches. Moreover, environmental liability coverage is gaining traction as organizations recognize the importance of mitigating potential environmental risks and liabilities.

Technological Advancements Impacting Liability Insurance

- Rise of data analytics enabling insurers to assess risks more accurately

- Integration of AI and machine learning for claims processing and risk assessment

- Blockchain technology enhancing transparency and security in insurance transactions

These technological advancements are reshaping the landscape of business liability insurance, allowing for more efficient risk management and personalized coverage options.

Credit: www.ramseysolutions.com

Frequently Asked Questions

What Is Liability Coverage For A Business?

Liability coverage for a business protects against financial losses from legal claims due to injuries or damages caused by the business operations. It helps cover legal fees and settlements.

How Much Is A $2 Million Dollar Insurance Policy For A Business?

The cost of a $2 million insurance policy for a business varies based on factors like industry and risk.

What Does Professional Liability Insurance Cover For A Business?

Professional liability insurance covers legal costs and damages if a business is sued for errors, negligence, or failure to perform services.

What Is Legal Liability In Business Insurance?

Legal liability in business insurance refers to the responsibility a company has to cover costs for claims or lawsuits. It protects against financial loss due to legal actions.

Conclusion

Protect your business with liability insurance to safeguard against unforeseen risks and potential financial losses. It’s a smart investment for long-term security and peace of mind. Consult with an insurance expert to find the best coverage tailored to your specific needs.

Stay prepared and proactive.